Innovation in financial services with AWS and BigCheese: from idea to deployment

BigCheese’ s experience in financial services innovation with AWS spans many areas, including:

- In-depth knowledge of the Uruguayan regulatory framework (provided by the BCU).

- AWS Cloud Adoption strategy for financial sector companies in Uruguay and the region.

- Training companies in the financial industry in the use of AWS services.

- Migration of specific workloads or the total operation of companies in the financial sector.

- Modernization of banking workloads to optimize performance and costs.

Within all this experience, we had never been part of the innovation process from the conception of a new product. Thanks to AWS and Midinero, we had the opportunity to facilitate and participate in an innovation workshop, which we thought was fantastic, so we want to tell you about this experience. This time, we have applied the method for financial services innovation on AWS.

The Working Backwards Methodology

This methodology is the one followed by Amazon itself to generate new products. According to Jeff Bezos:

“If done correctly, the ‘Working Backwards’ process involves a great deal of effort, but saves even more work afterwards. This process was not designed to be easy, but to save a tremendous amount of work on the back-end and to make sure we are actually creating the right thing.”

The methodology clearly does not guarantee the success of the new product, but it does shorten the time to validation, maximizes the chances of success and, in any case, generates lessons learned for the innovation of financial services in AWS in the future.

Its name comes from the fact that the methodology focuses on the end customer and works “backwards” to develop a product that meets the needs of that customer.

Some of the key aspects of this methodology:

- Starting with the customer. Who is the customer?

- Specifically, what is your biggest problem or opportunity?

- Facts, Behaviors, Goals, Conflicts.

- Recognize the “2 way doors”.

- “Disagree and commit.

- Write the “Press Release” of the product launch as soon as possible.

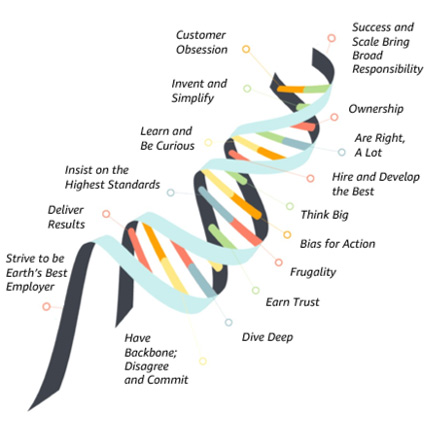

This Methodology is based on Amazon’s leadership principles:

Source: AWS.

This methodology applies to the conception of any type of product. Given the context, in our case it made a lot of sense to apply it to a company in the financial industry.

The Value of AWS Financial Services Innovation

AWS is not just about cloud services. AWS has a long history of innovation, with “failures” that have generated lessons learned, and has its origins in Amazon.com. The real value of AWS is that it has created the ability to share its innovation processes with its partners and end customers.

We’re not talking about technology, we’re talking about taking business to the next level, with validated methodologies that shorten paths and with AWS technology, deployed globally, as the vehicle to achieve business objectives.

In its “customer obsession”, Amazon gives us the possibility to replicate its formulas that have demonstrated tangible results at the level of innovation, with its clear example of AWS that has managed to be the number 1 cloud since its beginnings and and remains in this privileged position to this day..

Another intangible value of AWS is to be permanently attentive to market trends, always focusing first on its customers and the problems they will face. By way of example and within the subject of the post, the following are the trends in the Cloud Banking sector, according to AWS, for 2023:

Financial Services Innovation on AWS

Source: AWS

In future posts we will explain how AWS and BigCheese generate value in these 2023 trend points.

… and the value of BigCheese!

I see BigCheese as a key player in achieving customers’ business objectives and shortening process times. I base this assertion on the following points:

- Deep knowledge of the AWS ecosystem and programs to apply them in the most timely manner in the context of our customers.

- More than 7 years of experience as AWS partners, which endorse our technical and business support capabilities.

- Experience in the local market to best adapt the solutions available, according to the scale and context of the industries in Uruguay.

- Knowledge of Uruguayan regulations that allows us to advise our clients consistently.

- In Uruguay, the regulator of the financial system is the Central Bank of Uruguay (BCU). In a recent post by Sebastian Grattarola, CTO of BigCheese, on “Security in AWS for financial institutions” he elaborated on the recommendations of this institution regarding security aspects for financial institutions.

BigCheese’s values, whose main point of contact with AWS is the “customer obsession” but always putting people before technology. Here is our manifesto.

Having generated a relationship of trust with Midinero, having supported in the materialization of tangible results at the business level and knowing the possibilities of carrying out this Workshop, allowed us to facilitate this experience. And this is just the beginning of a new journey…

The outcome of the AWS Innovation Workshop for Financial Services

I take the words of Pablo Innella, CBO of BigCheese, to give an idea of the result of this experience:

“This week we held an innovation workshop with the Midinero Technology, Marketing, Business Intelligence and Strategic Projects team, with the support of Amazon Web Services (AWS) Partner First at their offices in Buenos Aires.

“Working Backwards” is the mechanism Amazon uses to innovate and launch new products, following 4 basic principles: obsession with the customer rather than the competition, passion for invention, commitment to operational excellence and long-term thinking.

Thanks to Midinero’s cuadrazo for sharing this instance with BigCheese, to David Marcelín Arévalo for the motivation, joy and courage to lead the workshop and to Jimena Agasi for the organization to the detail.”

We cannot give details of the product to come in Midinero, so for the moment the summary of the result would be: motivated work teams, with established synergies and a defined objective, which we will all pursue.