The Open Banking paradigm in Uruguay and its current status

What is Open Banking?

Open Finance or Open Banking is a paradigm that refers to financial institutions sharing customer information with third parties so that they can create innovative applications and services based on this data.

The following are the main characteristics of this paradigm:

1- Opening of financial data by financial institutions.

2- Use of APIs as data sharing mechanisms.

3- Following standards and regulations (local and international) to guarantee the privacy and security of personal and financial data.

4- Explicit consent of the user for their data to be shared and mechanisms to have control at all times of what data is shared and with whom it is shared.

5- Encourage innovation in financial solutions and competition among institutions in the industry, resulting in better benefits for end users.

From the above, the importance of having mature local regulations, aligned with international regulatory frameworks, which provide security to the local financial ecosystem, but above all to the end users of the financial industry, arises.

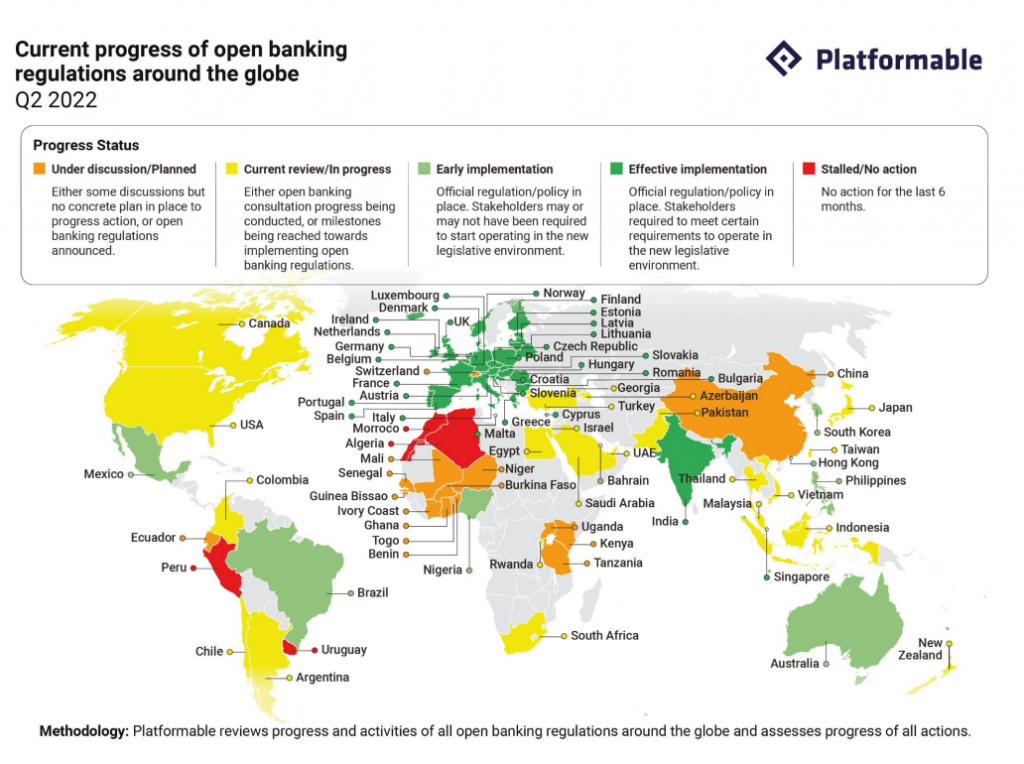

The following image shows the state of maturity of the regulatory systems of the different countries in relation to Open Banking.

Source: Platformable

Why Open Banking in Uruguay?

The quick answer would be: for greater benefits to the end user.

In a context of total dynamism generated mostly by technological advances, our interactions with the financial system are generally associated with more than one institution. This reality implies that the consolidation of information between these institutions will have to be done manually, if at all.

Some practical examples of being able to have a user’s consolidated financial information could be:

- Automated expense analysis.

- Generate savings options.

- Customized options for access to credit based on consumption.

- Maximization of the benefits associated with the use of banking products.

- Minimization of banking transaction costs.

These are just a few examples that would result in economic or time benefits for end users.

In short, it makes sense with the objective pursued by the Open Banking paradigm, innovation and competition among financial institutions, for better experiences and benefits for the end user.

To materialize the implementation of some of these examples (several in use in different parts of the world), different stages, or phases, must be followed, according to a BCU study:

Source: BCU

Open banking in Uruguay

In Uruguay, the regulator of the financial system is the Central Bank of Uruguay (BCU). In a recent post by Sebastian Grattarola, CTO of BigCheese, on “Security in AWS for financial institutions” he elaborated on the recommendations of this institution regarding security aspects for financial institutions.

The BCU already has this issue on its agenda. Since 2020 it has formalized this in a circular, stating that banks must provide access to their APIs so that they can be accessed by other providers in the country’s financial ecosystem.

There are working groups in this regard, and there is an agenda to study and advance the digital changes associated with the financial industry that are happening in the world.

There are already specific actions that we will see implemented very soon (I estimate this year) such as instant transfers between banks, at any time of the day (today transfers are instantaneous between accounts of the same bank). It is already very good to see concrete benefits from a roadmap drawn up more than two years ago.

It is also necessary to say that there is still a long way to go to be at the forefront of this Open Banking paradigm in Uruguay. Many challenges remain to be met, in my view, most of them associated with the regulatory framework, which is fundamental, as we have already expressed, to take care of end users and to maintain a healthy local financial ecosystem.

Open Banking and technological aspects

Today, the technology is already available to advance at a faster pace in these latitudes in matters related to Open Banking. BigCheese as an AWS Advanced Partner and soon to be AWS Financial Services Partner, has helped several financial companies in Uruguay and the region to advance in the digital transformation needed to the cloud so that these institutions can have a greater speed of innovation.

AWS has been a pioneer in the intersection of financial services and cloud technology, to the point of having a specific vertical for financial services and an even more specific one for banking. Thousands of financial institutions around the world are growing based on the use of AWS services.

There is no doubt that migrating workloads to AWS leaves institutions better prepared to innovate. The maturity of the market is there and demands to advance faster; the technology is available to respond accordingly; we still need adjustments to the regulatory framework to be able to create without limits and thus fully develop Open Banking in Uruguay.