AWS Success Stories in the Financial Industry

In the changing world of financial services, cloud adoption has become a key factor in driving efficiency, innovation and sustainability. Financial institutions around the world are turning to Amazon Web Services (AWS) to achieve exceptional performance and take advantage of the opportunities presented by digital transformation.

Migrating to the AWS cloud offers a set of business benefits ranging from operational efficiency to agility in solution delivery, allowing you to maintain a competitive advantage and lead in digital transformation in the financial industry. BigCheese, is one of the few partners in Latin America that is certified by AWS with the Financial Services Competency.

The business impact of adopting AWS:

- Cost Reduction: Migrating to AWS enables a 50% reduction in operating costs over a 5-year period, as well as a 25% decrease in infrastructure-related costs.

- Agility to Market: Experience a significant 43% decrease in the time required to bring new application features or functions to market, allowing you to respond more quickly to changing customer demands.

- Infrastructure Management Efficiency: Observes a 47% increase in the efficiency of IT infrastructure teams, resulting in better resource management and increased productivity.

- Dedication to Innovation: Experiences a 29% increase in staff dedication to innovation activities, which fosters the creation of new ideas and solutions.

- Increased Stability: Experience 69% fewer unplanned outages, improving the stability of your business operations.

- Speed of Deployment: Achieves an impressive 78% increase in the speed of deploying new compute or storage resources, allowing you to maintain a faster pace of development and adaptation.

- Continuous Innovation: Delivers 2.3x more new features per year, reflecting AWS’ ability to drive innovation and constant expansion of your services and products.

(Sources: IDC: Amazon Web Services Business Value and Hackett Group Cloud Services Study).

5 AWS success stories in the financial sector:

We will explore five examples of success in the financial sector, where AWS played a key role in achieving key objectives. These case studies highlight how financial institutions are reaping the benefits of working with AWS, including a specific case study from BigCheese (backed by their recent achievement of the AWS Financial Services Competency) that demonstrates their experience in successfully migrating Midinero to the cloud. From increasing operational efficiency to reducing the environmental impact of business operations, these case studies reflect how financial institutions are leveraging AWS capabilities to thrive in an ever-changing financial environment.

Migrating to the AWS cloud offers a set of business benefits ranging from operational efficiency to agility in solution delivery, allowing you to maintain a competitive advantage and lead in the digital transformation of the financial industry.

AWS success stories in the financial sector:

- Successful Midinero to AWS Migration by BigCheese

- Increased Operational Efficiency and Agility at NAB

- Accelerating Innovation and Speed to Market at Liberty Mutual

- Delivering Personalized Experiences at Trumid

- Security, Compliance and Resilience Enablement at AXA

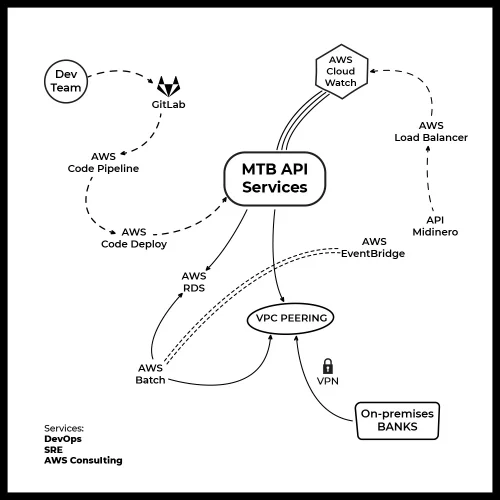

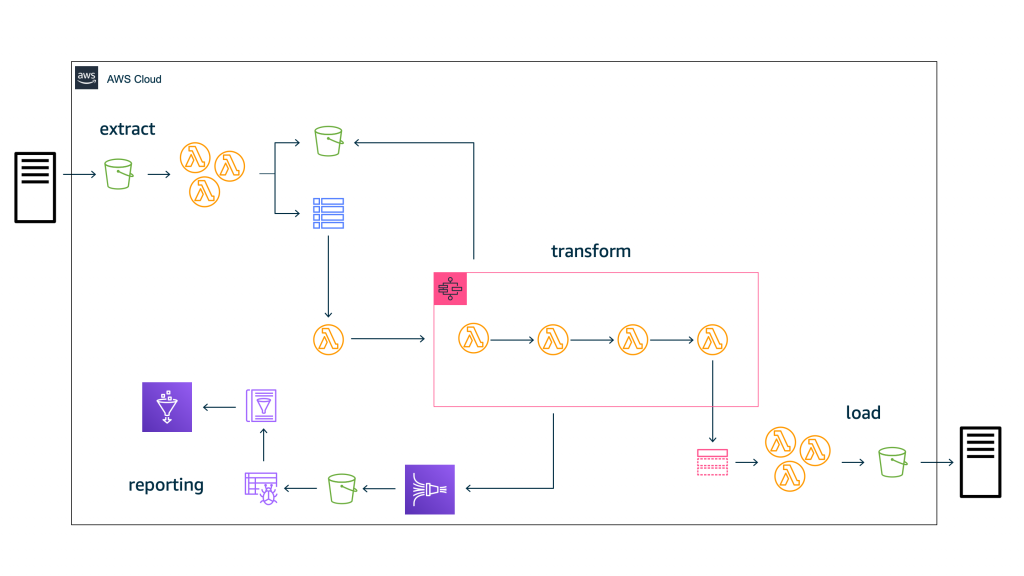

We begin our analysis of success stories in the financial sector with an example starring BigCheese: the “Successful Migration from Midinero to AWS”. This story illustrates how BigCheese, in collaboration with Midinero, successfully addressed the challenges of migrating a critical component in a highly regulated industry such as finance to the Amazon Web Services (AWS) cloud. Throughout this case, we will explore in detail how this migration not only ensured system security and availability, but also generated significant savings and improved operational efficiency, thus highlighting the positive impact of AWS technologies on the financial environment.

1. Successful Migration from Midinero to AWS by BigCheese

Midinero ‘s successful migration to the AWS cloud, led by BigCheese, represents an exemplary case in the financial sector. Midinero, a digital financial platform in Uruguay, faced the challenge of migrating its Bank Transfer Engine (MTB) from a local On-Premise infrastructure to the AWS Cloud. This was achieved without compromising safety and customer service quality, and with the goal of reducing costs and improving efficiency.

AWS Technologies Used

- Amazon Fargate

- Amazon RDS (Relational Database Service)

- AWS Batch

- AWS WAF (Web Application Firewall)

- Amazon Elastic Load Balancing

- Amazon VPN (Virtual Private Network)

- Amazon CodePipeline

- Amazon CodeBuild

- Amazon EventBridge

- AWS Organization

- Amazon CloudWatch

The Challenge

The main challenge was to migrate Midinero’ s Bank Transfer Engine (MTB) to the AWS cloud, ensuring the security and availability of the system in a highly regulated and sensitive industry in terms of financial data. The aim was to reduce costs and operational complexities, while maintaining service quality and minimizing operational disruptions.

The Results

The migration from Midinero to AWS brought significant results:

- 40% Reduction in Infrastructure Costs: AWS Fargate, with its auto-scaling capability, enabled a more efficient use of resources, reducing operating costs.

- Implementation of DevOps Practices: Adopting DevOps with AWS CodePipeline reduced the complexity and risk of new release deployments, resulting in greater flexibility and speed in development and delivery of functionality.

- Improved Transfer Efficiency: AWS’s ability to run batch jobs more efficiently dramatically reduced customer wait time to complete transfers, improving the customer experience by 75%.

Midinero’s successful migration to AWS not only met security and availability challenges, but also generated substantial savings and improved operational efficiency. This case highlights how the adoption of AWS technologies can be a key enabler for successful transformation in the financial sector.

2. Increasing Operational Efficiency and Agility at National Australia Bank (NAB)

National Australia Bank (NAB), one of Australia’s largest financial institutions, underwent a successful transformation by migrating its Murex MX.3 asset trading platform to the Amazon Web Services (AWS) cloud. This migration was aimed at improving the operational efficiency, agility and resilience of NAB’s critical capital markets operations. The migration to AWS enabled NAB to overcome the scalability, performance and cost challenges associated with its on-premises infrastructure, significantly improving stability and speed of development.

AWS Technologies Used

- Amazon EC2 (Elastic Compute Cloud)

- Amazon EC2 Spot Instances

- Amazon RDS (Relational Database Service)

- Amazon RDS for Oracle

- Amazon RDS Reserved Instances

- AWS Professional Services

The Challenge

NAB’s main challenge was to modernize its banking infrastructure to meet the demands of growth and regulation in the capital markets. Its Murex MX.3 platform required significant computational capacity and the ability to scale efficiently to support critical operations. NAB’s local infrastructure was limited in terms of scalability and efficiency, which affected the agility and performance of its applications.

The Results

NAB’s migration to the AWS cloud generated a number of positive results:

- Significant Reduction in Environment Creation Times: The environment creation process, which previously required 8 to 10 hours, was significantly optimized and now takes only 1 hour. This enhancement speeds up the deployment of new configurations and resources.

- Improved Recovery Speed: Recovery speed, which used to take several hours, has been drastically reduced to as little as 30 minutes. This ensures continuous availability of the systems and minimizes downtime in case of incidents.

- Significant Reduction of Production Costs in the Cloud: Compared to on-premises infrastructure, production costs in the cloud have been substantially reduced. This cost efficiency allows for a more effective allocation of financial resources.

- Significant Reduction in Cloud Overhead Costs: In the first three months following the launch of the new cloud infrastructure, overall cloud operating costs were significantly reduced, contributing to NAB’s financial efficiency.

- Highly Automated DevOps Processes: Highly automated DevOps processes were implemented, accelerating the delivery of new features and upgrades. This automation reduces risk and improves consistency in implementations.

- Accelerated Daily Reporting Performance: Daily report generation performance has increased by an impressive 30%, enabling more agile and timely data-driven decision making.

- Improved Scalability and Reliability: The migration to AWS has improved the scalability and reliability of NAB’s systems, ensuring smooth and efficient operation at all times.

- Training of 7000 Staff Members in Cloud Skills: As part of this transformation process, training was provided to 7,000 NAB staff members in cloud-related skills, strengthening the team’s ability to operate and optimize systems in the AWS environment.

NAB’s successful migration to AWS not only improved operational efficiency and agility, but also generated significant cost savings and greater resiliency in its financial operations. This case highlights how cloud adoption can be a key driver for transformation in the financial sector.

3. Accelerating Innovation and Speed to Market at Liberty Mutual

Liberty Mutual, a leading insurance provider with a vision to become a global digital enterprise, embarked on a digital transformation focused on customer-centricity, agility and cloud-native development. By adopting aserverlessstrategy and leveraging Amazon Web Services (AWS), Liberty Mutual reduced costs and significantly improved its time to market. This approach relieved engineering teams of the operational burden and accelerated the creation of agile, high-quality applications.

AWS Technologies Used:

- Amazon Lambda

- AWS Cloud Development Kit (AWS CDK)

- AWS Step Functions

- Amazon EventBridge

- AWS Well-Architected

The Challenge:

Liberty Mutual faced the challenge of modernizing its local systems and becoming an agile, customer-centric company in a highly competitive global marketplace. The company wanted to accelerate application creation, reduce operating costs and free engineers from operational tasks to focus on innovation.

Results:

- Reduced application creation time from one year to only three months.

- Processing of one hundred million transactions per month in its centralized system.

- IT costs reduced to USD 60 per million transactions.

- Implementation of more than 3500 Serverless patterns in one year with AWS CDK.

- 50% increase in workload execution on AWS by 2020.

- Elimination of the infrastructure maintenance burden on personnel.

- Increased system flexibility and strength.

- Increased employee engagement and satisfaction.

Liberty Mutual has successfully transformed to Serverless infrastructure with the help of AWS, enabling it to be more agile, reduce costs and deliver higher quality solutions to its customers in less time. Collaboration with AWS has become an integral part of Liberty Mutual’s success, and the company continues to expand its Serverless approach to continue to innovate and deliver exceptional value to its customers around the world.

4. Delivery of Personalized Experiences in Trumid. Development of advanced machine learning systems in Trumid with Deep Graph Library for Knowledge Embedding.

The corporate bond industry is diverse and challenging, with specific needs of institutional clients. Trumid, a financial technology company, is transforming the credit trading experience by adopting artificial intelligence and machine learning (AI/AA) solutions. This personalized approach is achieved through AI models that optimize the trading experience and provide traders with relevant and valuable information.

AWS Technologies Used:

- Deep Graph Library (DGL-KE)

- Amazon SageMaker

- Amazon Lex

- Amazon Personalize

- Amazon Textract

- Amazon Connect

The Challenge:

Trumid, in its quest for a more personalized trading experience, partnered with the AWS Machine Learning Solutions Lab to develop AI/AA systems that model user interests and preferences for bonuses available on its platform. The challenge was to create a system that would provide highly relevant and accessible information to traders, speeding up the time needed to make informed decisions.

Results:

To address this challenge, Trumid and the AWS Machine Learning Solutions Lab developed a comprehensive data preparation, model training and inference process based on deep neural networks using Deep Graph Library for Knowledge Embedding (DGL-KE). An end-to-end solution was deployed using Amazon SageMaker.

Benefits of Graph Machine Learning:

The representation of data in the form of a graph allows rich and relevant information to be extracted from the relationships between entities.

Graph machine learning algorithms are ideal for domains with interconnected data, such as financial trading platforms.

What is a network? A custom network, in the context of computer science and data science, refers to a network (a data structure representing relationships between elements) that has been specifically designed to meet the particular needs or requirements of a particular application or problem. Unlike generic or standard networks, a customized network is optimally adapted to a specific scenario.

The characteristics of a custom network can vary widely depending on the application, but generally include:

- Nodes and specific relationships: Nodes represent entities or elements, and the relationships between them are defined according to the context of the application. This allows accurate and meaningful relationships to be modeled.

- Custom properties: Each node or relationship can carry specific properties that store information relevant to the application. These properties can be values, attributes or metadata that help in data processing.

- Adapted structure: The network structure is adjusted to efficiently reflect the relationships and connections in the application domain. This may include optimizing the network topology to improve the speed and efficiency of query processing.

- Specialized algorithms: Custom graphs are often accompanied by customized search and analysis algorithms that are tailored to the specific needs of the application.

Solution Implemented:

A graph of interactions between traders, bonds and issuers was constructed using historical trading data.

A knowledge graph embeddings model was developed with DGL-KE to predict future interactions.

The solution was packaged as a scalable workflow using SageMaker Processing for implementation.

Significant Results:

The custom graph model improved performance by 80%, with more stable results for all types of traders.

The improvement was measured by the percentage of actual trades predicted by the recommender (mean recall) and was reflected in additional metrics ranging from 50% to 130% improvement.

This implementation allowed Trumid to offer a richer and more personalized trading experience, overcoming the limitations of manually coded rules. The collaboration with the AWS Machine Learning Solutions Lab supported Trumid’s continued innovation in delivering cutting-edge solutions to its user community.

For more information, see the additional resources mentioned in the article: Developing advanced machine learning systems at Trumid with the Deep Graph Library for Knowledge Embedding.

5. Security, Compliance and Resilience Enablement at AXA

In the case of AXA, a leading multinational insurer with a presence in more than 60 countries and more than 106 million customers worldwide. AXA sought to enable security, compliance and operational resilience at scale by adopting AWS.

AWS technologies:

- Global Landing Zone: AXA implemented a customized global landing zone using AWS services and best practices.

- Encryption: AWS provides encryption capabilities that help ensure data security and privacy in the cloud.

- Network Configuration: The AWS network infrastructure allows AXA to configure and manage networks efficiently and securely.

- IAM Integration: AXA integrated AWS Identity and Access Management (IAM) to control and secure access to resources and services.

- Compliance Monitoring: Using AWS tools, AXA was able to monitor and ensure compliance with preventive and detective controls in its infrastructure.

- Cloud Migration: AXA migrated 25% of its 6,000 eligible applications to the AWS cloud as part of its cloud-based technology strategy.

- Machine Learning: AWS provides advanced machine learning capabilities that AXA uses to implement new features and services faster and more efficiently.

- Chatbots: AXA leverages the chatbots capabilities offered by AWS to improve interaction with its customers and users.

- Business Intelligence: The AWS infrastructure gives AXA the ability to use business intelligence tools to gain valuable insights from its data.

These AWS technologies played a key role in AXA ‘s technology transformation and in enabling its operations on a global scale.

The Challenge:

AXA faced the challenge of transforming its infrastructure safely and efficiently in a highly regulated environment. The company needed to ensure consistency throughout the organization and establish sound technical standards. To achieve this, AXA implemented a customized “global landing zone” on AWS. This allowed local teams to autonomously test, validate and propose changes while centrally monitoring compliance with security and compliance controls.

AXA’s Results Implementing AWS:

- AXA has deployed its “global landing zone” in more than 350 AWS accounts, successfully migrating 25% of its 6,000 eligible applications to the cloud.

- The implementation of AWS has enabled AXA to accelerate the delivery of new products and services, using capabilities such as machine learning and chatbots.

- Security and compliance have been significantly improved, complying with the specific rules and regulations of the financial services industry.

- Automation plays a key role in AXA’s operational efficiency, which has led to greater agility in an ever-changing business environment.

AXA has positioned itself as a success story in the secure adoption of the AWS cloud, highlighting the importance of having trusted partners on the journey to digital transformation in the financial sector.

BigCheese, the partner certified in Financial Services by AWS

Cloud transformation is a strategic journey for any organization, and its success requires solid planning and total commitment. Modernization, optimization and the creation of new processes are key to maximizing the value of technology.

On this journey, organizations can count on BigCheese (a certified AWS Financial Services partner) to provide the necessary expertise and support. BigCheese has excelled in the successful implementation of cloud solutions for financial institutions, and its industry expertise is a valuable asset for those looking to accelerate their cloud transformation.

At BigCheese, we are committed to helping organizations like Midinero accelerate their cloud transformation by providing the tools, expertise and best practices necessary for continued success in an ever-evolving financial world.